Your Approximate Home Insurance Cost Explained

If you’re trying to figure out how much home insurance costs, you’re not alone. We often get this question, especially from first-time homeowners or individuals relocating to places like Texas, Colorado, Missouri, or Tennessee. So, let’s walk through it together. We’ll discuss what most people pay, why those numbers can vary, and how to determine what the approximate home insurance cost looks like for your home.

What Is the Approximate Cost of Home Insurance in the U.S.?

On average, the approximate home insurance cost in the U.S. runs somewhere between $1,400 and $1,900 per year. That breaks down to about $120 to $150 a month.

But here’s the thing: the cost of your home insurance can swing quite a bit depending on where you live, what kind of house you have, and the coverage you choose.

If you’ve got a smaller home in a low-risk area, your premium could be under $1,000. On the other hand, homes in high-risk areas or with more square footage might see rates closer to $2,500 per year or even higher.

So while it’s good to know the average, the best number is the one that’s tailored to your specific home and needs.

Let’s put some real-world numbers out there. If your home is valued at around $300,000, your home insurance premium might land between $1,200 and $1,900 per year.

Here’s a rough look at average rates by state:

- Texas: About $1,850 a year

- Colorado: About $1,650 a year

- Missouri: About $1,450 a year

- Tennessee: About $1,400 a year

Keep in mind that these are just benchmarks. Your actual rate could be lower or higher depending on discounts, your deductible, and your home’s specific risks. However, it gives you a decent place to start the conversation.

Monthly vs. Annual Premiums: What to Expect

Most quotes are shown as a yearly total, but many homeowners want to know what their homeowners insurance’s typical cost looks like month-to-month, especially if it’s tied to their mortgage payment.

Let’s break it down:

- A $1,500 yearly premium is about $125 per month

- A $1,800 yearly premium is around $150 per month

If you’re paying through an escrow account with your mortgage, this is usually included in your monthly payment. But even if it’s bundled in, it’s worth keeping an eye on it so you know what you’re actually paying.

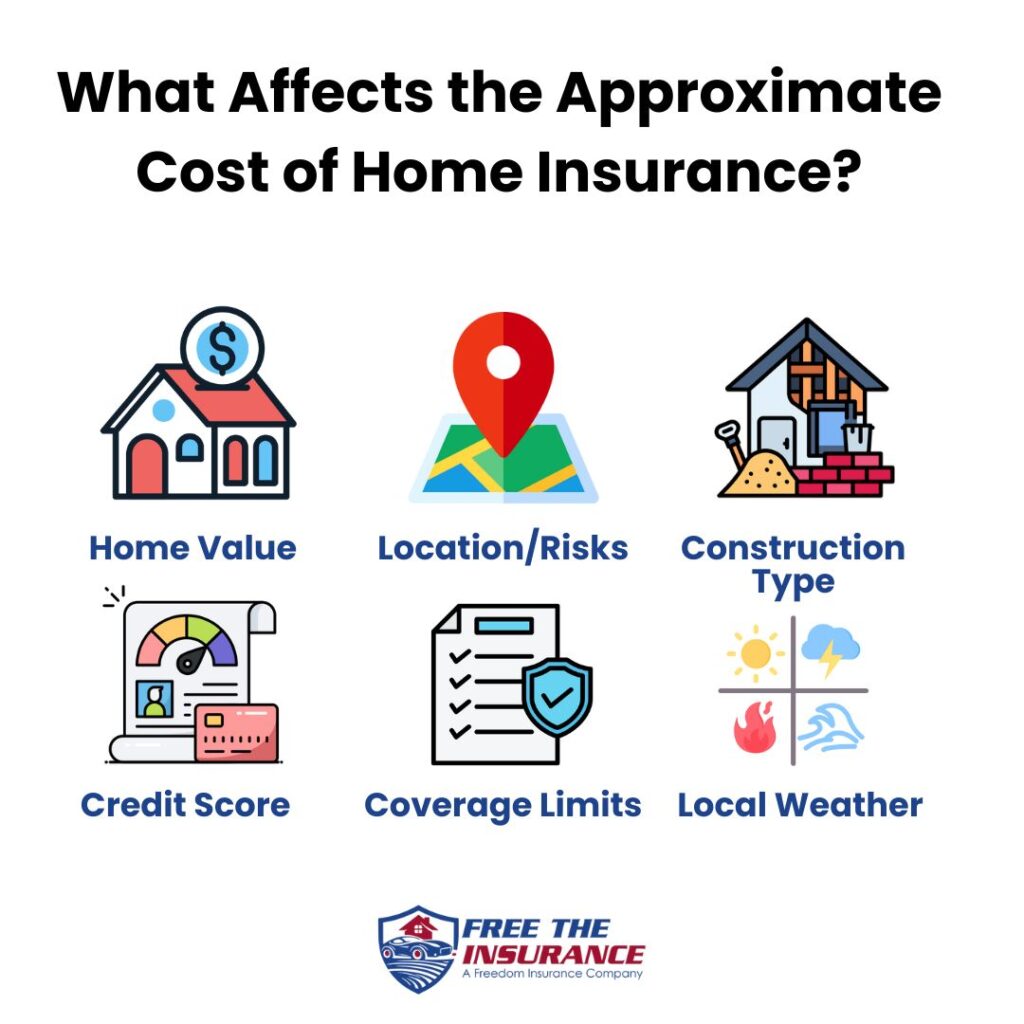

Why Costs Vary by State, Home, and Coverage

Insurance rates aren’t one-size-fits-all. They’re shaped by a mix of your location, the details of your home, and what kind of protection you’re looking for.

For example, someone living near the Gulf Coast will have different risks than someone in the Colorado Rockies. Your home’s age, building materials, and even your credit score can all factor into the price.

Then there’s coverage. A bare-bones policy with a high deductible will cost less, but might not offer the protection you need. A more comprehensive policy will cover more, but you’ll pay a little extra for that peace of mind.

The key is finding the right balance for your budget and your situation.

Factors That Drive State-Specific Rates

Different states face different risks, and insurers adjust prices based on how likely claims are in your area. For example:

- In Texas, hailstorms and tornadoes are common, so premiums reflect that.

- Colorado sees heavy snow and wildfires, which can drive up rates.

- Missouri gets a mix of severe weather and flooding in certain areas.

- Tennessee deals with storms and has a range of urban and rural home types.

Even homes just a few miles apart can have different rates based on crime stats, fire protection, or flood zones. That’s why it’s so important to get a quote that reflects your exact address, not just a state average.

How Often Do Home Insurance Costs Change?

Your home insurance cost isn’t fixed forever. In fact, it’s pretty common for premiums to go up a little each year. That’s usually because of:

- Rising costs to rebuild homes

- Local or national claim trends

- Changes in your home’s value

- Adjustments based on your claim history

Even if you haven’t filed a claim, insurers may still raise rates across the board due to what’s happening in your region. It’s a good idea to review your policy annually. Not only to compare prices, but to make sure your coverage still makes sense.

How to Estimate Your Own Homeowners Insurance’s Typical Cost

While your actual premium depends on several personal factors, there are a few smart ways to get a solid estimate, without needing a math degree. Let’s walk through your best options in finding your home insurance’s approximate cost:

Use Online Estimator Tools

Many insurers offer free quote tools right on their websites. You’ll usually plug in details like your ZIP code, home size, age, and construction type. These calculators can give you a ballpark figure in minutes. However, it’s important to remember that they’re estimates, not guarantees.

Review Average Rates in Your Area

State averages can give you a rough idea of what others are paying. For example, insurance costs in Texas or Missouri may differ based on local weather risks, home values, and crime rates. This won’t be exact to your home, but it’s a good benchmark.

Talk to a Local Agent for a Personalized Quote

The best way to get an accurate number? Speak with a licensed agent. They’ll factor in your home’s specific features, your coverage needs, and any discounts you qualify for. Plus, they can help you avoid overpaying or being underinsured.

While even agents are delivering what are ultimately estimates, there is no better way to find an accurate representation of the approximate cost of home insurance than with a licensed expert.

Help Finding Your Approximate Home Insurance Cost

If you’re interested in finding your approximate home insurance cost, we can help. Our team is here to help you with accurate, personalized home insurance quotes. No pressure, no hype, just honest estimates to help you compare carriers and make an informed decision.

Sources:

National Association of REALTORS. Accessed July 2025.