When to Bundle Home and Auto Insurance and Save

If you want to bundle home and auto insurance, you’re going to save money…at least that’s what most people think. While it’s a popular idea found in marketing slogans and commercials, coverage in real life will vary. Bundling homeowners and car insurance may be a great way to save for one household, but not necessarily the best for another.

Our guide helps you understand what bundling really means, how it works, and whether it’s the best option for your situation.

What Does It Mean to Bundle Home and Auto Insurance?

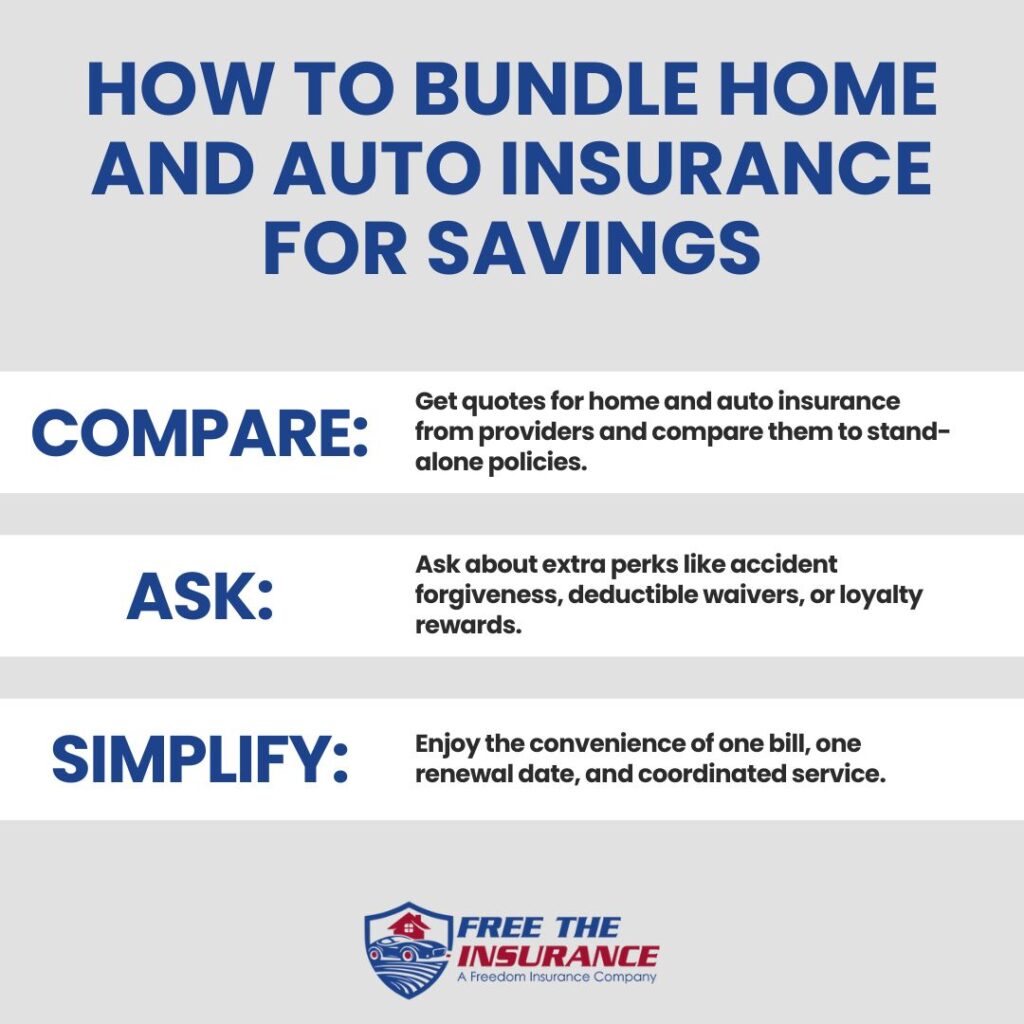

Bundling means purchasing your home insurance and auto insurance policies from the same provider, usually resulting in a multi-policy discount. It’s a popular option because it simplifies your insurance life. One company, one renewal date, one bill. That alone can make things feel a lot less chaotic.

But there’s more to bundling than meets the eye. Yes, you may save money, but the real value comes in how much smoother your coverage experience can be, especially when it’s time to make a claim or manage your policy long-term.

When both policies are under the same roof, your insurance provider has a clearer picture of your needs, making it easier to coordinate service and spot savings opportunities that might otherwise be missed.

Think of it as building a relationship with your insurer, not just buying two products from the same store.

Is It Better to Bundle Home and Auto Insurance?

The short answer? Often, yes. However, “better” depends on more than just price. Bundling is best when it aligns with your lifestyle, risk profile, and goals, not just your budget.

Let’s break down some less obvious reasons bundling might actually work in your favor, and a few instances where it might not.

Coordinated Claims Can Make a Big Difference

Here’s something people don’t always think about: What happens if a natural disaster damages both your car and your house?

If you’re bundled with one insurer, the claims process is generally more streamlined. That could mean:

- One claims adjuster instead of two

- Simpler paperwork

- Faster communication and resolution

This becomes especially important when you’re dealing with a stressful situation like storm damage or theft. Having both policies under one provider can save time—and sometimes, your sanity.

Loyalty Discounts Get Better With Time

Bundling home and auto insurance doesn’t just give you a one-time break on your premiums. Some providers actually increase your discount the longer you stay with them. It’s like a frequent flyer program, but for insurance.

Loyal customers may be rewarded with:

- Additional discounts for years of continuous coverage

- Reduced deductibles over time

- Priority service or extra perks (like deductible waivers)

So while the initial discount might be modest, the long-term benefits can really add up if you plan to stick with the same provider.

Simplified Billing and Renewals

Managing separate policies can mean juggling different due dates, paperwork, and renewal periods. Bundling helps keep everything aligned. That means:

- One bill

- One renewal date

- Fewer chances to miss a payment

It also makes reviewing your insurance easier. When both your home and auto policies renew at the same time, you can review your coverage annually and make adjustments based on life changes, such as buying a new car, moving, or adding drivers to your policy.

This is a small thing with a big impact. When life gets busy, and let’s face it, it always does, having fewer moving parts is a relief.

When Bundling May Not Be the Right Fit

Bundling sounds great, but it’s not always the smartest move, especially if your personal risk profile throws things off balance.

High-Risk Homes or Drivers Can Offset the Savings

If your house is located in a flood zone or wildfire-prone area, or if you have a spotty driving record, bundling might actually increase your overall premium.

That’s because the insurer has to take on more risk across both policies, which can reduce the discount or cause one policy to be more expensive than if purchased on its own.

Before bundling, always compare bundled quotes vs. individual policies. It might be more cost-effective to split them, especially if one policy is high-risk and the other is standard.

You Have More Leverage When You Bundle During a Switch

Here’s a tip most people don’t consider: Switching both policies at the same time can give you more negotiation power.

When you’re shopping for new insurance, providers are often more competitive when they know you’re bringing them double the business.

They may be willing to offer:

- Steeper discounts

- Perks like roadside assistance or deductible forgiveness

- Lower rates to win your business over a competitor

So even if you’re happy with your current provider, it’s worth getting quotes elsewhere, especially if both your policies are up for renewal.

Some Bundles Offer Perks Beyond Savings

Not all benefits show up as a discount on your bill. Some insurers include special perks with bundled policies, like:

- Accident forgiveness for auto claims

- Waived deductibles if both your home and car are damaged in the same event

- 24/7 customer support or concierge service

These perks aren’t always advertised, so be sure to ask what else comes with your bundle. Sometimes, the extras are worth more than the 10% discount you thought you were getting.

Bundling Doesn’t Guarantee Great Coverage

Here’s a myth worth busting: just because you’re bundled doesn’t mean you’re getting the best protection.

Always review what you’re actually being offered:

- Are your home’s replacement costs fully covered?

- Does your auto policy have sufficient liability limits?

- Are there any exclusions that could leave you exposed?

Don’t trade quality for convenience. The goal is smart coverage, not just simpler billing.

Yes, you should aim to save money, but if you’re not getting the protection you need, you could be setting yourself up for a big headache and larger bill down the road.

So, Should You Bundle Home and Auto Insurance?

If you’re looking for simplicity, better coordination, and long-term value, bundling can be a smart move. It’s especially useful if you:

- Prefer to manage everything in one place.

- Want to maximize loyalty perks over time.

- You like the idea of extra protection options that come with bundled perks.

But it’s not a one-size-fits-all solution. High-risk situations, nonstandard coverage needs, or better standalone deals may steer you in a different direction.

If you’re curious whether bundling works in your favor, we can help. We’ve walked hundreds of people through these decisions, and we’re happy to help you compare your options with zero pressure.

Want to see if you should bundle auto and home insurance? Get a personalized quote today, and compare the best options in your area.

Sources:

Investopedia. Accessed August 2025.