How to Insure Manufactured Homes: A Complete Guide for Homeowners

Homeowners looking to insure manufactured homes need to have the right protection at the lowest price. While it’s similar to finding a traditional policy, there are nuances that can affect your cost and coverage. Our guide helps you make sense of it all and find an appropriate policy for your needs.

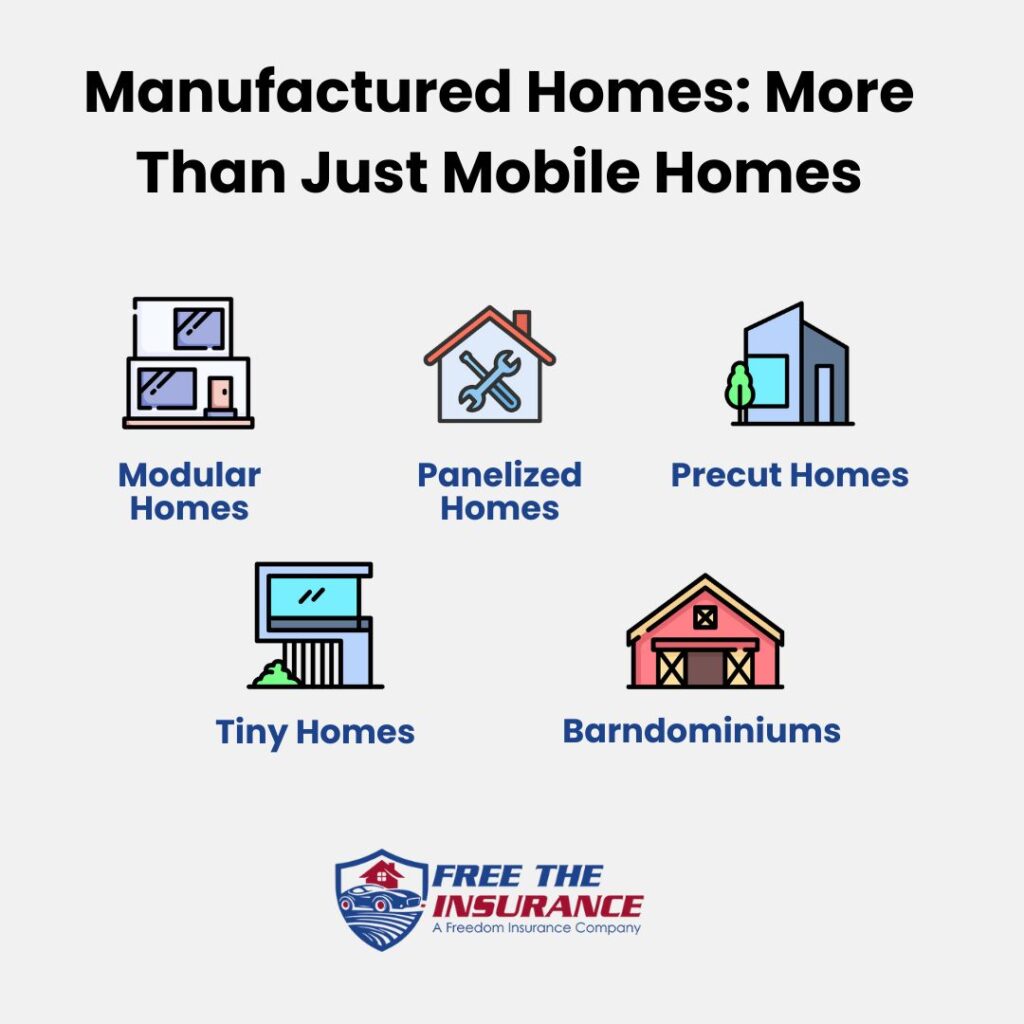

What Does It Mean to Insure a Manufactured Home?

When we say insure manufactured homes, we’re talking about protecting them with a policy built specifically for the way these homes are constructed and used.

Manufactured homes, including mobile homes, are built in factories and then placed on permanent or semi-permanent foundations. Because of that, standard home insurance doesn’t always fit the bill.

Homeowners insurance for manufactured homes gives you a safety net if your property is damaged by things like fire, hail, or theft. It usually includes liability coverage, too, just in case someone gets hurt on your property.

While it works similarly to traditional home insurance, there are some important differences.

How your home’s value is calculated, what perils are covered, and which companies write these policies can all vary. Whether you live inland or along the coast, understanding the basics is key to getting the right protection.

Why Manufactured Homes Need Specialized Insurance

Just like any home, a manufactured home faces risks: weather events, theft, accidents, and more.

But manufactured homes often differ in their construction materials and foundation types, which can affect how they hold up during a storm or other damaging event.

This makes having the right insurance, not just a basic policy, essential.

Traditional insurance carriers may not cover manufactured homes or may only offer limited options. That’s why manufactured home insurance companies specialize in this type of coverage, offering policies that account for:

- Anchoring systems and skirting

- Transport risks (if the home has recently been moved)

- Foundation type (on blocks, piers, or permanent foundation)

- Optional add-ons like flood, hurricane, or earthquake coverage

Getting the right policy means working with a company that understands the unique risks these homes face. Especially in states like Texas, where coastal weather is a concern.

What Does Manufactured Home Insurance Typically Cover?

Insuring a manufactured home is similar to any other house. However, these policies typically offer specific protection that reflects the unique risks of factory-built homes.

Manufactured home insurance offers similar protection to standard homeowners policies but is tailored to the specific risks these homes face, like increased vulnerability to wind or fire.

It covers your home, belongings, other structures, liability, and temporary housing. Depending on where you live, you may need extra coverage for floods, wildfires, or earthquakes.

What’s the Difference Between “Mobile Home” and “Manufactured Home” Insurance?

Technically, the term “manufactured home” applies to homes built after June 15, 1976, under the HUD code. “Mobile home” is an older term used before these construction standards were put into place.

Insurance companies often use the terms interchangeably, but it’s important to check that your policy is:

- Rated for your home’s year of construction

- Based on the current value and not depreciated unless you choose ACV (actual cash value)

How Much Does Homeowners Insurance for Manufactured Homes Cost?

On average, manufactured home insurance coverage costs between $300 and $1,000 per year, depending on several key factors:

- The age, size, and value of your home

- Its location (coastal, rural, wildfire zone, etc.)

- Whether it’s on a permanent foundation

- Your claims history and credit score

- Selected deductibles and add-ons

If you live in coastal states like the Gulf Coast or areas with tornado risks like Missouri, your premium might be higher.

However, there are still ways to find affordable insurance for coastal manufactured homes, including state-specific discounts and bundling options.

Can You Insure a Manufactured Home on a Permanent Foundation?

Yes, and in fact, being on a permanent foundation can actually lower your rates. It adds stability to the structure and can make your home eligible for more traditional coverage options.

Insurance companies may also see homes on permanent foundations as less risky to insure, which means:

- More providers are available to quote you

- Access to better policy features

- Lower deductibles in some cases

If you plan on anchoring your home permanently, notify your insurance provider. It could save you money and give you access to a broader selection of insurers.

How to Compare Manufactured Home Insurance Quotes

Shopping around is key. You can’t assume that every provider will offer you the same protection or price. That’s why it’s important to get manufactured homes insurance quotes from more than one company.

Here’s what to look for:

- Clear policy language (no guesswork)

- Coverage limits that match your home’s value

- Deductibles that fit your financial comfort zone

- Optional coverage for natural disasters in your region

- Reputation and customer service quality

Work with an agent who understands this niche, as it makes all the difference when it comes to finding homeowners insurance for manufactured homes that actually protects your lifestyle.

At the end of the day, insurance isn’t just about checking a box; it’s about protecting your home and your future.

Whether you’ve just moved into your first manufactured home or are comparing new quotes, we’re here to help you make sense of it all.

We’ve helped hundreds of families get covered across Texas, Missouri, Colorado, and Tennessee.

Our licensed agents understand the unique challenges of how to insure manufactured homes and can help you get a quote that fits your home and your budget.

Sources:

HUD. Accessed August 2025.